SWIFT transfers are transactions made via the SWIFT international payment network. The abbreviation SWIFT stands for Society for Worldwide Interbank Financial Telecommunications.

The Society for Worldwide Interbank Financial Telecommunications, typically known as SWIFT, provides a secure, standardised network condition allowing financial institutions to exchange information about financial transactions globally.

With more than 35 million transactions through its network daily, SWIFT is one of the most common ways to transfer money internationally. According to the US Treasury, SWIFT handles about $5 trillion daily or about $1.25 quadrillion yearly given that there are about 250 business days per year.

The number looks significant; however, the number of transactions completed for crypto transfers using the TRON network can sometimes exceed these numbers. It can process 172.8 mm transactions via TRON per day. That is a whopping 2 000 transactions per second.

How long does it take for the SWIFT transfer to arrive?

The standard SWIFT transfer is significantly slower compared to local transfers, for example, SEPA, e-transfer, etc. It has the option of a paid upgrade, which drastically can increase its capabilities. However, usually, the SWIFT transfer takes several business days to arrive, so don’t expect to see your funds the next day when choosing SWIFT.

How does SWIFT work?

When the sender's and recipient's banks have a commercial relationship, money is delivered quickly: as soon as the destination bank receives the SWIFT inquiry from the sending bank.

But if the two banks do not have an explicit agreement, one or several corresponding banks may assist with the process, increasing the costs and time of the transfer.

Since SWIFT is used for cross-border payments, the original currency may be converted to the destination country's currency; one of the banks involved in the transfer will usually do the currency exchange. Double currency conversions may occur depending on the senders and destinations currencies.

When using SWIFT, you are not truly sending a money transfer. Such a payment is referred to as a "payment order" between two banks. To complete an international SWIFT transfer, you will need to know your SWIFT code.

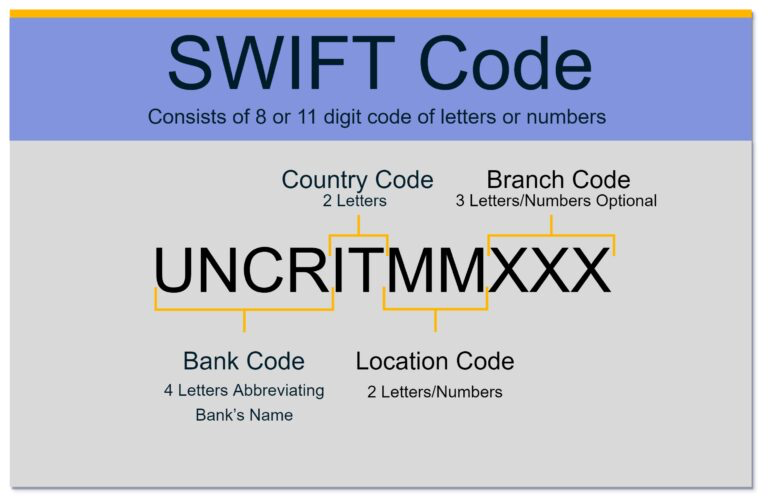

A unique SWIFT code consists of 8 to 11 characters. The components for the code include:

-

Bank code

-

Country Code

-

Location code

-

Branch code

You will also need your IBAN for the SWIFT transfer.

IBAN is an International Bank Account Number. It is used to identify an individual account involved in an international transaction.

How Much Does SWIFT Cost?

Large banks and financial institutions may charge anywhere from $25 to $65 per outgoing wire transfer. Charges vary depending on the bank and can be waived for specific accounts. Receiving the SWIFT usually costs around $10-$25. The fees depend on the commissions that the corresponding banks charge. In comparison, if you wish to send an international transfer using crypto (using the TRON blockchain), it would cost you only $1.

SWIFT transfers are available for all Banxe customers.