Business banking with crypto

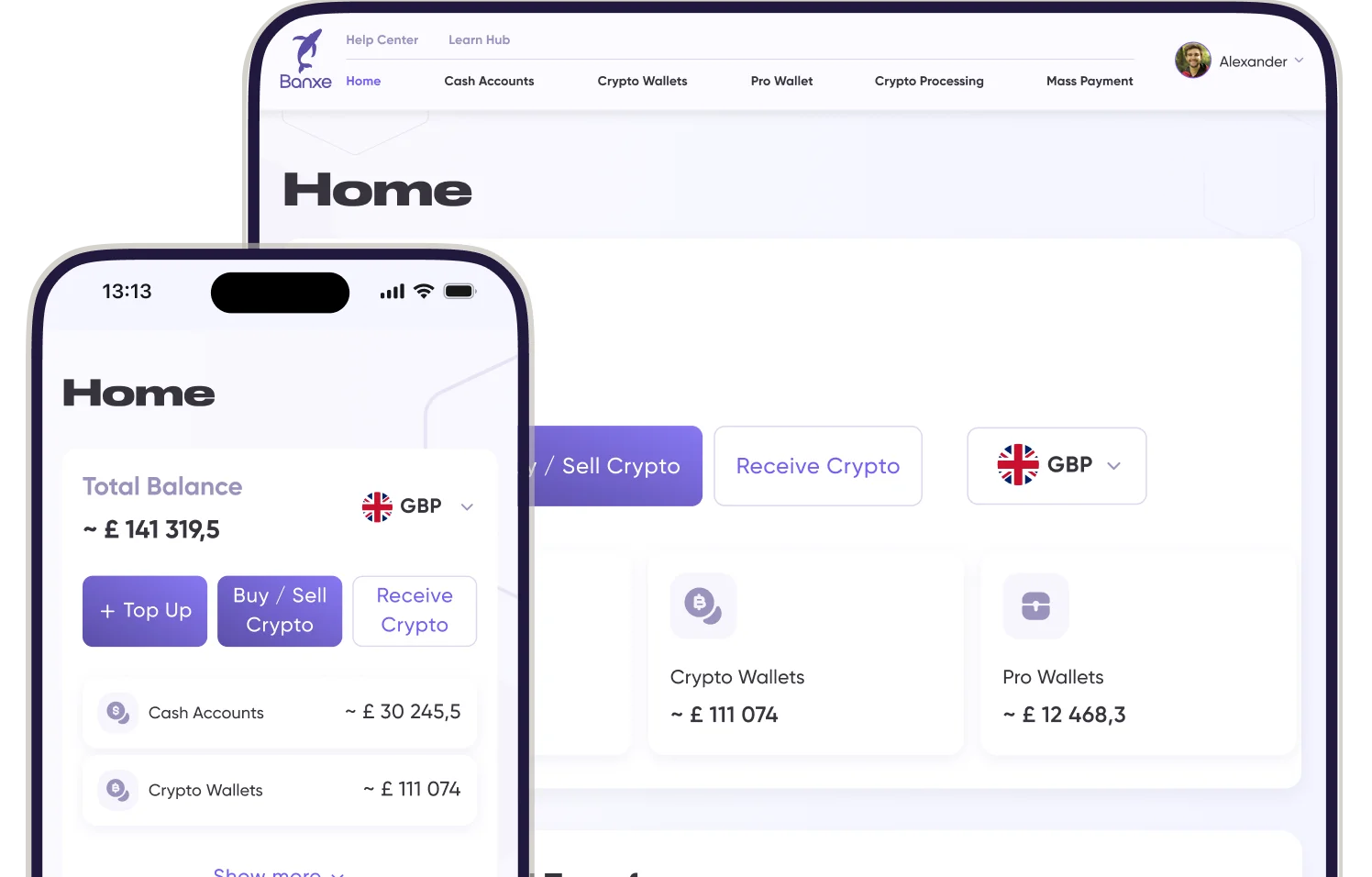

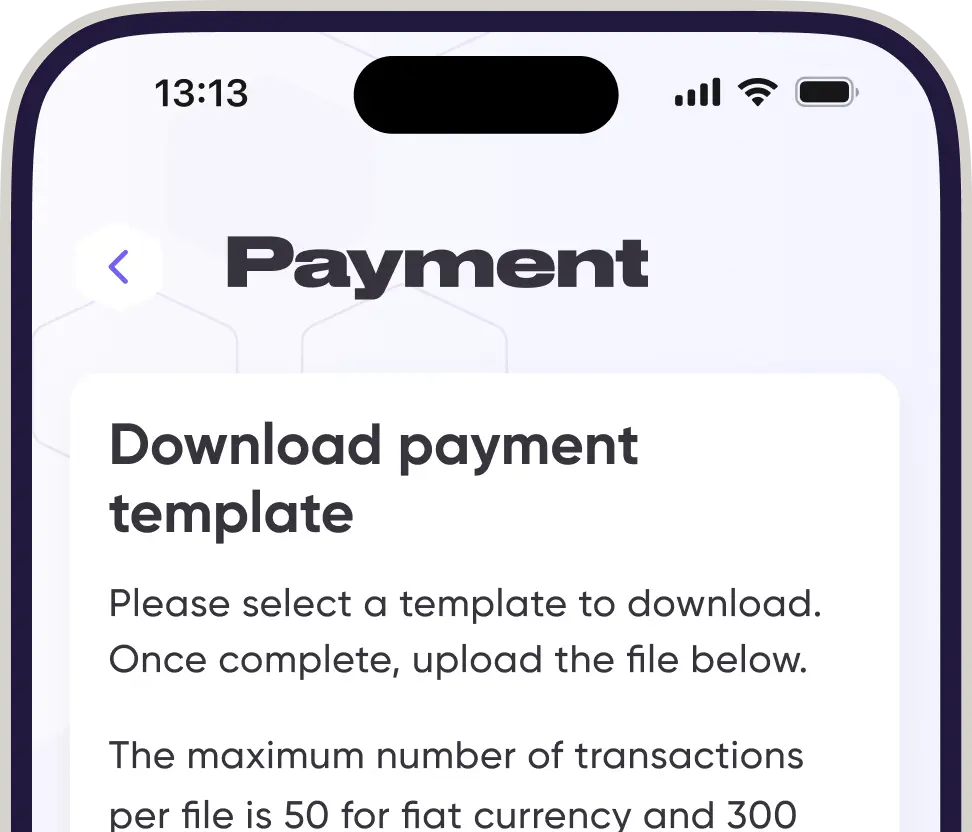

Local and global payments in one account

Make large-volume exchanges with special rates

Corporate debit cards for the whole team

Buy and sell crypto at market rates

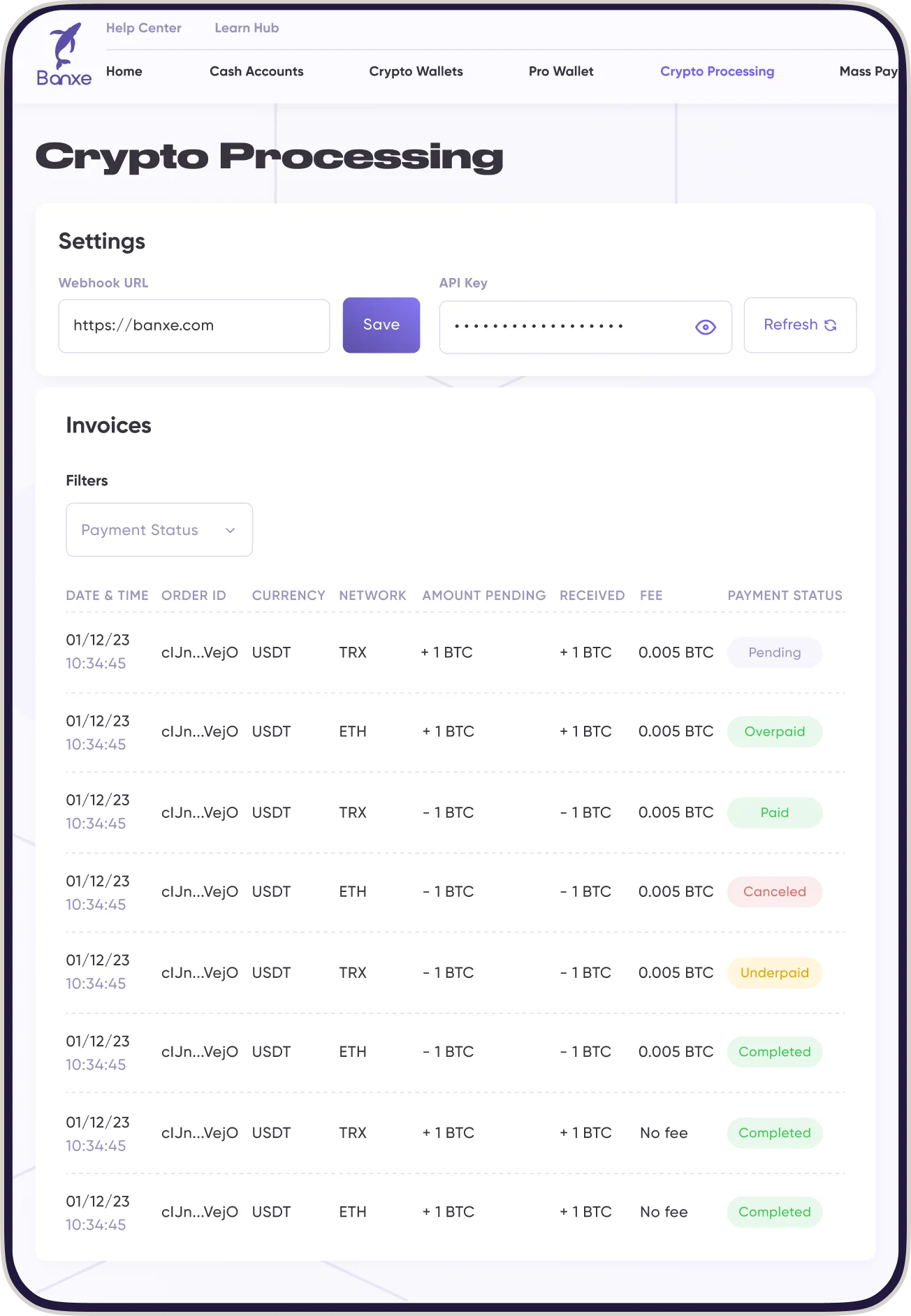

Accept payments in cryptocurrency

Take control of your business spending

A partner you can trust

Start banking with Banxe today

Hear what our customers are saying

Frequently Asked Questions

What is Banxe?

Banxe is a platform that provides banking and crypto services for both individuals and businesses. Pay, receive, send, exchange, and earn with us. We support EUR, GBP, USD and 350+ cryptocurrencies.

How do I get started with Banxe?

To register an account, please follow these steps: Click the "Get started" button in the right upper corner, enter your email and chose a password (min. 8 characters, at least 1 uppercase, 1 digit, and 1 special character), go through identity and account verification, top up your account. You're ready to use Banxe!

How can I withdraw my money?

If you wish to withdraw fiat funds select the 'Send Cash' button and fill in the required fields to complete the transfer. You will be prompted to complete the 2-factor-authentication to finalise the transaction. You may also withdraw fiat funds through an ATM by using your Banxe Card. If you wish to withdraw cryptocurrency, select the 'Send Crypto' button and fill in the required fields to complete the transfer. You will also be prompted to complete this 2-factor-authentication to finalise the transfer.

What countries are supported?

Banxe is available in the UK, EU, and the following countries: Australia Canada Chile Dominica Georgia Grenada Hong Kong Israel New Zealand Saint Lucia Saint Vincent and the Grenadines Singapore South Korea Taiwan United States Uruguay Bahrain Japan Montenegro Qatar Saudi Arabia South Africa Argentina Malaysia Seychelles Ukraine Andorra Liechtenstein Monaco San Marino Kazakhstan

How do I top up my account?

You can top up your Banxe account with a Card, SEPA, SWIFT, or CHAPS.

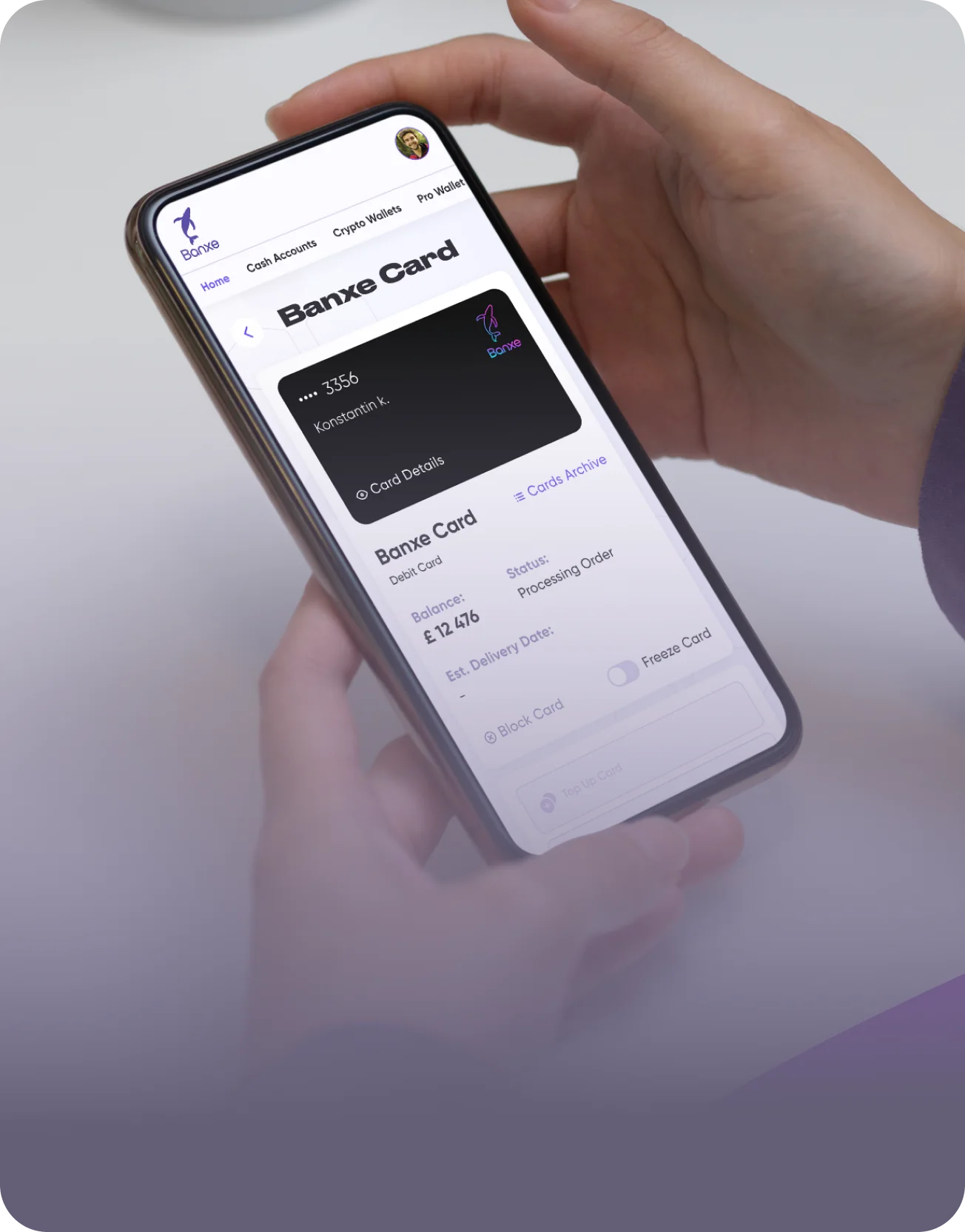

What is a Banxe Card?

The Banxe Card is a debit card. It can be used in the same way as a standard debit card.

What coins are listed on Banxe?

There are currently more than 350 coins available on Banxe.

What are the account fees?

The pricing plans are built to reflect individual needs. To see the full pricing, click here