Opening a bank account in the UK may seem challenging at first. How would you feel about doing this for free? We prepared our complete tutorial on how to open a bank account in the UK. We will guide you through the procedure to guarantee that you can save money on your financial solution.

Whether you’re a student, a dedicated businessperson, or a person interested in streamlining your cash payments, this is the way to do it all without a hitch. Let’s go ahead and create a free account in the UK.

Required Documents and Eligibility to Create Bank Account Online?

If you want to get a bank account online, you must meet the eligibility criteria. Additionally, you will have to provide the necessary documents to the banks:

Eligibility Criteria

-

Age: You need to be 18+ to open an account. Few banks allow younger people to create their accounts. However, these accounts are limited in terms of features and services;

-

Residency: You have to be a resident of the United Kingdom. A few banks may also ask for you to be in the UK for a certain period;

-

Credit History: Banks check your credit history before opening your account. Ensure that you meet the bank's credit score requirements before opening an account.

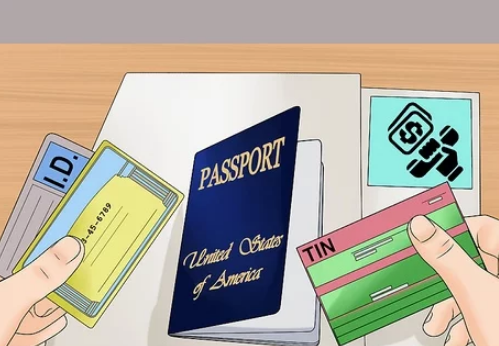

Necessary Documents

-

Proof of Identity: It can be your driver's license, valid passport, or any ID that has your photo and name and is issued by the government;

-

Proof of Address: It can be your utility bills, a council tax bill, or a UK driving license.

-

Tax Information: Some banks may ask for your Tax Identification or NI (National Insurance);

-

Personal Info: It is your fore and surname, your DoB, mailing address, and active mobile number.

Important! You must ensure that you scan and upload these documents for online applications. You must have access to a camera, scanner, or online scanning application.

Factors to Consider for the Best Banks to Get a Bank Account

To create a bank account online in the United Kingdom, researching and selecting the right one is crucial. Here is a table showing some important considerations:

|

Factor

|

Description

|

|

Mobile and Internet Banking

|

Verify if the bank offers mobile and internet services. This covers online bill payment, transfers, and balance checks.

|

|

Customer Service

|

Check the quality of customer support the bank offers. Excellent customer service can make banking much simpler and more pleasurable.

|

|

ATM and Branch Availability

|

Check whether there are ATMs or physical branches available. This is a crucial consideration if you require frequent access to ATMs or prefer branch banking.

|

|

Features of Account

|

Assess the key features the bank account is offering. This could include interest rates, credit limits, and other advantages.

|

|

Reputation

|

Research and review the reputation of your chosen bank. Check user reviews and suggestions to locate a trustworthy bank.

|

Step-by-Step Guide to Opening a Free Bank Account

If you know the procedures, opening a free online account in the UK is relatively easy. This comprehensive, step-by-step tutorial will make a bank account creation process easy for you:

Step 1: Research

Research and locate a number of reputable banking service providers that offer free accounts in the United Kingdom. Moreover, consider a number of factors, including Internet banking, ATM availability, reputation, and customer support. You can also consider alternatives like

Banxe

and

Wise

.

Step 2: Choosing a Bank

After your research is complete, check the factors you searched for and decide which of the options supports your needs to the fullest.

Step 3: Online Application

Now, visit the official website of the bank or app and search for "Create Account" or "

Get Started

." Then, fill out an online application form.

Step 4: Fill the Application Form

The application form will ask for personal info, for instance your forename and surname, DoB, contact number, and current residential address. Fill out this form with accurate information; otherwise, it may be rejected.

Step 5: Submit Necessary Documents

After you fill out the form, the financial institute will ask you to submit a few necessary documents. These documents can include proof of your current address and identity proof.

Step 6: Submit and Wait for Approval

After the forms’ completion, proofread the info to make sure it is correct. Finally, wait for the banking service provider to review your application.

The review periods take time and can make you wait for a few days. The bank may contact you through call or email to ask for additional information if needed.

Step 7: Activation

After you receive account approval, they will provide you with instructions on how you can activate your approved account.

Important! If the bank is unsure about the information you provided, it may ask you to visit its nearest branch to review your documents.

Common Mistakes to Avoid when Creating a New Account

There are a few typical mistakes to watch out for while creating a

free bank account in the United Kingdom

:

-

Not checking eligibility criteria;

-

Not reading the fine print;

-

Selecting the wrong bank;

-

Ignoring internet and app banking features;

-

Not preparing necessary documents;

-

Not securing your account.

Conclusion

Finally, creating a free bank account in the UK is easy if you are well-prepared and well-informed. The given guide includes a step-by-step plan, from reviewing the acceptance criteria and preparing the needed documents to choosing the best bank based on various relevant factors.

The initial and most crucial steps involve diligent research, making an informed decision, and submitting a meticulous application. By sidestepping typical errors, you can safeguard your financial well-being in the UK.