Cryptocurrency is becoming a popular payment and strategic investment option for businesses. Understanding how business crypto buy/sell works is critical for any business, whether its goal is to increase transaction efficiency or diversify its investment portfolio.

From creating a company account to buying cryptocurrencies for the first time, this in-depth guide ensures you have all the knowledge necessary to navigate the world of corporate cryptocurrency transactions confidently. Explore and learn how your business may use cryptocurrencies to its fullest potential.

Can a Business Buy Cryptocurrency?

Yes, you can buy crypto as a business with ease. In addition to being lawful, the practice is becoming increasingly popular as businesses look to expand into new markets, simplify payments, and diversify their holdings. Take a close look at the reasons behind this and the strategies businesses use to interact with cryptocurrencies such as Bitcoin.

Legal Considerations

Businesses need to be aware of the legal environment before entering cryptocurrency. Regulations can differ significantly depending on the nation and even the state. Businesses can purchase, hold, and trade cryptocurrencies in the UK and other jurisdictions.

However, they must abide by strict regulatory guidelines. This frequently entails ensuring the proper paperwork is in place, abiding by anti-money laundering (AML) regulations, and finishing the required verifications.

Benefits of Buying Crypto as a Business

Using and purchasing cryptocurrencies can be quite advantageous for businesses. Here are a few main benefits if you're a business looking to buy crypto with a business card:

|

Benefit

|

Description

|

|

Diversification

|

The distinct asset class that cryptocurrencies provide can aid in diversifying an organization's investment holdings. This may lower risk and increase rewards, particularly during difficult economic times.

|

|

Payment Flexibility

|

Accepting and paying using cryptocurrencies can simplify transactions, particularly when doing business internationally. It may also decrease transaction fees and the requirement for currency exchanges.

|

|

Future-Proofing

|

Being early adopters of cryptocurrencies can put companies at the forefront of innovation as the digital economy expands. It conveys to partners and customers that the business is progressive and flexible.

|

|

Liquidity and Accessibility

|

Liquidity is provided by the ease with which cryptocurrencies like Bitcoin (BTC) may be purchased and sold on different exchanges. Businesses can now more easily manage their cash flow and investments dynamically.

|

Important! Remember that using cryptocurrency carries risks in addition to rewards. Conducting in-depth studies and speaking with a financial advisor is crucial when making big decisions.

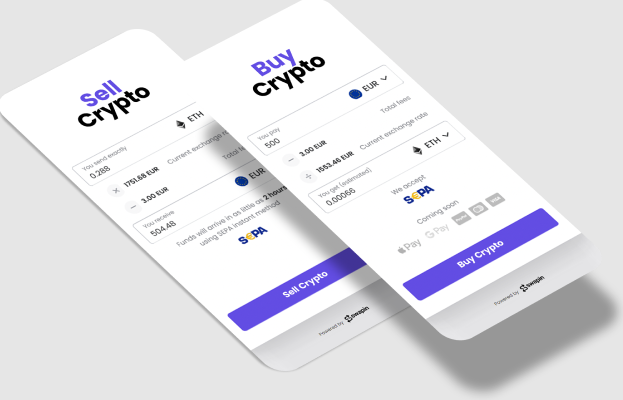

How to Buy Crypto as a Business: Setting Up a Business Account

To buy crypto as a business, you need to create a unique business account. This guarantees streamlined transactions, regulatory compliance, and transparent financial records. Here's how to get started, step-by-step:

Step 1: Choose the Right Financial Institution

Choose a bank or other financial organization that accepts cryptocurrency payments. Make sure they provide company accounts designed with digital assets in mind.

Step 2: Prepare Required Documentation

You must ensure all the necessary documentation is ready for the financial providers. Here are some of the documents that you need:

-

Proof of business incorporation;

-

Business licenses;

-

Identification of key executives (e.g., passports or driver's licenses);

-

Financial statements.

Step 3: Open a Business Account

Make an application for a business account at the bank of your choice. Send the proper paperwork and fill out any documents the bank requests.

Step 4: Select a Reliable Crypto Exchange

Select a trustworthy crypto exchange with business account options. Kraken, Binance, and Coinbase are a few well-liked choices. Make sure the exchange offers dependable customer service and strong security measures.

Step 5: Complete the Verification Process

You must complete a KYC (Know Your Customer) procedure to buy and sell crypto as a business with the most exchanges. Exchanges use the KYC procedure to check the authority of your business. You can verify the KYC by submitting documentation like:

Step 6: Link Your Business Account or Credit Card

When your company credit card or bank account has been validated, connect it to the cryptocurrency exchange. To prevent problems, make sure your financial institution accepts cryptocurrency transactions.

Step 7: Set Up Security Measures

Put robust security measures in place to safeguard your cryptocurrency holdings and company account. Some of the security measures you can set up include:

Step 8: Make Your First Purchase

You can now purchase cryptocurrencies after setting up your account and completing security procedures. To become comfortable with the procedure, start small and raise your investment gradually as your confidence grows.

The Best Banks to Buy Crypto as a Business in the UK

Selecting the correct bank is crucial as cryptocurrency adoption by UK businesses for transactions and investments grows. Cryptocurrency transactions are safe, effective, and compliant with the proper bank.

Below, we've outlined the main characteristics, advantages, and disadvantages of the top UK banks for businesses looking to purchase and manage cryptocurrency.

Businesses that deal in fiat and cryptocurrency will find Banxe an ideal next-generation financial platform. With dedicated IBANs and support for over 350 cryptocurrencies, Banxe makes it easy to transact locally and internationally through SEPA, FPS/CHAPS, and SWIFT.

Its cutting-edge security features, 3D Secure, and competitive real-time currency conversion rates guarantee quick and painless transactions. For companies operating in the modern digital era, Banxe is the best option due to its Pro Wallet and its ability to integrate with other business tools.

Pros:

-

Over 350 cryptocurrencies alongside fiat currencies;

-

Facilitate local and international transfers with SEPA, FPS/CHAPS, and SWIFT;

-

Benefit from competitive and updated currency exchange rates;

-

3D Secure ensures transaction safety;

-

Seamless integration with accounting and other business tools;

-

Secure and efficient management of digital assets.

Cons:

-

It may lack some conventional banking services that traditional banks offer;

-

Requires familiarity with digital and cryptocurrency transactions;

-

Some advanced features may not suit businesses that prefer simpler, traditional banking methods.

Revolut is an online banking platform that makes it easy for companies to purchase, store, and sell bitcoins. Its adaptable services and user-friendly interface have made it especially well-liked.

Revolut is perfect for companies that need fast and effective financial administration because it supports many digital assets and offers real-time transaction updates. Its smartphone app makes management and access simple when on the road.

Pros:

-

Easy integration with business accounts;

-

Support for multiple cryptocurrencies;

-

Competitive transaction fees and exchange rates;

-

Real-time transaction updates;

-

Mobile-friendly platform.

Cons:

-

Limited customer support options;

-

Potential for account freezes during high volatility;

-

It is not a traditional bank, so some traditional banking services are missing.

Formerly known as The Provident Bank, BankProv is a contemporary financial institution that facilitates Bitcoin transactions for commercial clients and offers specialized services for the digital asset market.

With extensive experience, BankProv supports cryptocurrency businesses by fusing cutting-edge services with traditional banking traditions. Its main goal is to offer banking solutions that are safe, legal, and suitable for the digital economy's demands.

Pros:

-

Strong focus on cryptocurrency and digital assets;

-

Comprehensive business banking solutions;

-

Robust security measures;

-

Experienced in regulatory compliance;

-

Offers commercial lending options.

Cons:

-

Limited physical branch access;

-

Higher fees compared to some digital-only platforms;

-

Still expanding its crypto services.

Wirex is a digital payment platform that combines traditional banking and cryptocurrency services to simplify business trading and management of digital assets. With its multi-currency accounts, switching between cash and cryptocurrency is easy. Wirex is a dependable option for companies due to its affordable exchange rates and safe, controlled environment.

Pros:

-

Multi-currency accounts, including crypto;

-

Instant crypto-to-fiat conversions;

-

Competitive exchange rates;

-

User-friendly app interface;

-

Secure and regulated platform.

Cons:

-

Limited traditional banking features;

-

Occasional service outages;

-

Limited customer support response times.

The well-known online bank Ally Bank, which offers affordable rates and user-friendly services, has expanded its services to enable business Bitcoin transactions.

Many small and medium-sized businesses find Ally Bank's high-interest savings account and no-fee structure appealing. Its user-friendly web interface and round-the-clock customer care make finances easier.

Pros:

-

High-interest savings accounts;

-

No monthly maintenance fees;

-

24/7 customer support;

-

Easy-to-use online banking interface;

-

Competitive rates on business loans.

Cons:

Important! Please be aware that changes in regulations or the bank's policies may cause a bank's level of crypto-friendliness to fluctuate over time. Before making decisions, call the bank to ensure you have the most recent information.

Tips for Companies Looking to Buy Crypto as a Business

Following best practices and doing thorough planning are essential when managing cryptocurrencies as a business. Here are some useful pointers to make sure your business manages cryptocurrency assets legally and efficiently:

Tip 1: Best Practices for Managing Crypto Assets

-

Portfolio Diversification: Avoid concentrating all of your money on a single cryptocurrency. Spread out your investments to reduce risk;

-

Employ Secure Wallets: Keep your cryptocurrency in secure wallets, including hardware wallets, to guard against theft and hacking;

-

Frequent Audits: Make sure your cryptocurrency holdings are appropriately handled and recorded by conducting routine audits;

-

Insurance: Consider getting insurance for your cryptocurrency holdings to guard against losses from fraud or cyberattacks.

Tip 2: Keeping Track of Transactions and Accounting

-

Use Crypto Accounting Software: To precisely track transactions and valuations, use specialized crypto accounting software;

-

Record Keeping: Keep thorough records of every transaction, including the dates, sums, and counterparties;

-

Reconciliation: To guarantee accuracy, reconcile your cryptocurrency transactions regularly with your financial statements;

-

Professional Assistance: To help with bookkeeping and tax compliance, engage the services of an accountant with knowledge of Bitcoin.

Tip 3: Regulatory Compliance and Staying Updated with Laws

-

Recognize Regulations: To guarantee compliance, familiarize yourself with the rules controlling cryptocurrencies in your jurisdiction;

-

Stay Informed: Join industry groups and follow reputable news sources to stay current on changes to laws and regulations regarding cryptocurrencies;

-

Programs for Compliance: Establish internal compliance systems to ensure your company complies with all applicable rules and regulations;

-

Legal Advisor: To negotiate the complicated regulatory landscapes around cryptocurrencies, seek the advice of legal specialists.

Final Thoughts

Businesses are starting to use cryptocurrency as a smart investment and payment method. Any business, whether trying to diversify its investment portfolio or improve transaction efficiency, has to understand how business crypto buy/sell works.

With this comprehensive tutorial, you may buy cryptocurrencies for the first time or create a company account, and you'll be well-equipped to handle corporate cryptocurrency transactions confidently.

Businesses can efficiently and legally manage their cryptocurrency holdings by adhering to the suggested best practices and useful advice.

This guide offers an extensive roadmap, catering to queries such as "Can I buy crypto with a business account?" or "What are the benefits and legal considerations of crypto investing?" Use cryptocurrencies' potential to put your company at the forefront of the digital economy, protect your capital, and streamline operations.