The best accounts for students play crucial roles in their financial experience at university. Do you want to learn about choosing the best bank account before attending university? This guide has everything you need to know to make the best decision.

What does a student account mean?

Considering the name, you may have an insight into what the student bank account means. Just as you may have rightly guessed, it is an account meant for university students. Unlike regular savings accounts, several benefits are connected to this type of account, including overdrafts without interest.

One cannot open this account without proving studentship. Moreover, updating one's finances with the right body after account opening increases one's chances of qualifying for decent offers.

As a student with this account type, you enjoy an interest-free overdraft until after graduation. On the other hand, you may have loved everything about your student account as an undergraduate. This account type gives you the privilege of upgrading to a graduate account. This also qualifies you to carry on with your interest-free overdraft. As time passes, you enjoy lower interest rates on the borrowed cash.

Best student account selection

Students may be at the receiving end if they are not familiar with how the best bank accounts for students work. Perks and incentives often act as bait to get your attention, but never forget these factors when choosing one:

1. Do not be overwhelmed with excessive freebies

Nothing beats freebies on student accounts, but you must not be carried away with these offers. Shunning perks like travel discounts and other intriguing incentives may not be easy, but learn to be smart when making decisions.

2. Small overdrafts are bad for you

There are times you may be out of cash, an arranged

overdraft

is one of the reliable ways you can take loans through a current account. The most incredible part about this is that you won't be overcharged when paying back. Qualifying for this perk means no need for excess payment but the exact borrowed amount.

Transferring some cash into your savings account is another viable option, especially when a full overdraft is unsuitable. This is another means of generating additional cash on the initially borrowed cash. Be informed of the timeframe on borrowings before interest accrues. The cash borrowed starts accruing interest a few years after graduation.

3. Be sure if an overdraft is an 'up to' or 'guaranteed'

Students usually find phrases like 'up to' in interest-free overdraft advertisements. Most banks only make this offer available to students in their last year at university. However, credit ratings are determinants in this scenario.

4. Be informed of repayment conditions

One good thing about repaying borrowed cash is that it doesn't occur immediately after graduation. However, you may suddenly find it challenging to start sourcing a refund for the borrowed cash. Think of the inconvenience when you suddenly need to repay £3,000. This is why you must live ready before repayment comes knocking. Familiarizing yourself with the conditions of paying back the borrowed money is a good way to live-ready.

5. Credit rating

Taking an overdraft is equivalent to borrowing money. One of the key features that qualify students for this is to have an outstanding

credit score

. This plays a role in the overdraft amount receivable. A better score or rating heightens your chances of being approved to borrow money. There are also different places to get a free credit score, including Experian.

The best student banks: what are the benefits?

There are several benefits with this type of account, but the most notable among them is that students can borrow without paying excess when it is time to pay back. This is a benefit you will never find with regular current accounts. As such, students stand a better chance of borrowing up to £3,000 while studying. Moreover, they are not paying interest until after they complete their education.

When comparing students ' bank accounts, freebies on offers and available overdrafts are worth considering. As such, students must not decide on choosing a bank just because of the perks it offers. Although deals can vary from bank to bank, the following benefits await you:

-

Apps or services subscriptions;

-

Participating-restaurants discounts;

-

Cash usage Cashback at participating retailers' stores;

-

⅓ Britain trains transport costs on students' railcards.

The Downsides

Students bank accounts may be one of the nicest decisions any potential student can make, but these disadvantages should never be an oversight:

-

Reduced interest in student bank accounts compared to other account types. This decision may be unpalatable if you have debts with hopes of receiving interest on your cash;

-

Borrowing money without interest may be very tempting, causing students to spend beyond their budget. Students must always remember that the money they borrow isn't free and will be paid back at some point after their education;

-

If you are going to the UK or England to study as a foreigner, you need a bank that operates globally for students' accounts. However, these incredible interest-free perks may elude you.

Creating a student bank account: The detailed requirements

Like regular bank accounts, students looking forward to creating an account will require certain documents, whether part-time or full-time. However, there is a distinction between these two accounts: opening an account as a student means you are preparing for higher education. According to some banks, an overdraft is possible for anyone who has attained 18. As such, having some documents in place qualifies you to open a student bank account:

-

Verification of your address;

-

Passport or other supported means of identification

-

An unconditional offer letter of confirmation from universities and college admission service

-

You need a confirmation letter of A-level results from your school if your offer comes with conditions

These requirements prepare you to create and operate an account. In addition to the above, the credit score threshold plays an important role. The usual practice for most banks is to automatically convert this account type to a graduate account. However, this only takes place when you may have graduated. As such, students can pay their borrowings over a specific period.

The Best Accounts for Students

Different factors contribute to students choosing the best bank accounts. For example, a specific bank may offer students mouthwatering discounts on selected restaurants. However, this may be unhelpful for those who don't visit restaurants to eat. Therefore, you must always ensure that the benefits of offers suit your needs.

Moreover, you must consider the bank branch's proximity. Banking with a bank close to your residence in the university means you will get in-person help as quickly as possible when issues arise without needing to travel to another location. Lastly, a larger interest-free overdraft may be one of the things you like, a perk common with student accounts. Most importantly, do not forget that overdraft is equivalent to debt, payment will be required at a point. Here are the top bank accounts for students:

|

Banks

|

Top feature

|

Overall offerings and benefits

|

|

NatWest

|

£100 cash perks plus free Tastecard to boot

|

-

The bank gives you a hundred pounds after the first ten days of creating your account;

-

Multi restaurants support Tastecard worth 39 pounds every year, giving you up to fifty percent discount;

-

Allows you to create an account within the year's first half;

-

Borrow up to 2,000 pounds without interest in the first year, plus an additional 3,000 pounds three years later.

|

|

Nationwide

|

100 pounds cashback

|

-

Up to 100 pounds on FlexStudent account creation upon 500 pounds minimum. However, you must replenish the account before December 15th;

-

Take loans without interest in your first year. This could be up to 1000, 2000, and 3000 pounds in your 1st, 2nd, and 3rd year respectively;

-

You can create an account for up to five months or twelve months later, even when your course is yet to commence.

-

Termly payments of £500 minimum;

-

3+ years course completion tiered payment.

|

|

Santander

|

Free railcard for four years

|

-

Save about ⅓ of rail in Britain, also saving about £182 yearly on a four-year Railcard worth a hundred pounds;

-

Borrow money without interest, up to £1800 & £2,000 in the fourth and fifth year respectively;

-

Fantastic offers from Santander boosts, such as cashback;

-

First and third-year borrowing, up to £1,500 without paying interest.

|

|

Hongkong and Shanghai Banking Corporation

|

Cash bonus, loans

|

-

A £100 on account opening or upgrade. Additionally, you're subscribed to a 365-day mindfulness app;

-

Borrow money up to 1000 and 2000 pounds in your first and third year without paying interest;

-

Control your expenses using different budgeting tools;

-

3,000 pounds limit without an interest in year one. You also enjoy a reduced 2,000 pounds two years after leaving university.

|

|

Barclays

|

Paid access to an online textbook library

|

-

Borrow up to 1,500 pounds without interest in your year two and an extra 500 pounds upon finalizing account creation;

-

A 365-day paid access to Perlego where you enjoy unlimited access to online textbooks;

-

Account opening with Barclays app with identity, selfie, universities and college admission service code, so, no need to look for a close branch.

|

The best account for students: How do I know the best one for me?

Bank accounts play a significant role in one's experience throughout the study. As such, one must carefully weigh the choices available to choose the most appropriate one.

About 18% of students and graduates do not spend up to 60 minutes on account selection, while 23% choose based on their existing customer relationships. About 44% agreed that bank incentives are a crucial factor to consider for account selection. However, when comparing perks, you must not sideline the effect of choices on your lifestyle. For example, a free railcard on a current account may not suit your needs if you are leaving for the university with a car.

18% of the respondents think that the size of interest-free loans is crucial when making bank selection choices. On the other hand, 25% opined that the longevity of the payback time after graduation should be the topmost priority, maybe 2 or 3 years, according to a Forbes Advisor's research.

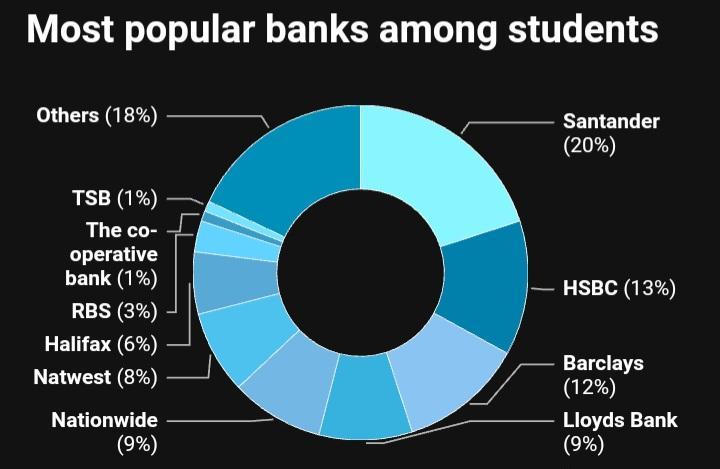

A 2023 survey reveals students' top bank choices, source:

https://www.savethestudent.org/

Creating an account

Eligibility is the foremost factor in account creation. Upon qualification, the whole process is straightforward. It can be done online or at a bank's branch close to you.

Keep your information updated with Student Finance once the account opening is completed. Updated information helps your account receive any student loans or grants.

The perfect time for account creation

The perfect time is any time from when you get your A-level or Scottish Highers results. Moreover, the process can begin immediately if you're confirmed in the selected university. You can initiate the process before the commencement of study if you have unconditional UCAS offers.

July and August are common months when many high street banks roll out fantastic student deals. Therefore, early application may also mean you will wait to weigh in on the available options.

Account creation before the term begins allows you to enjoy additional time carefully setting it up with the financial body. It also creates additional time to pay bills, such as phone, accommodation, etc. Finally, there is enough time to leverage the offers and freebies available at your selected bank.